how are rsus taxed in the uk

However HMRC is generally prepared to reduce the UK tax liability to reflect the relative number of workdays that you have spent in the UK and the other country between grant and vesting of the option and the subsequent grant and vesting of the restricted stock units except where there. Less Employer National Insurance 138-2760.

Top Five Tax Surprises With Multiple Jobs Overemployed

The United Kingdom pays tax only on RSUs when they vest.

. The gain from the sale of shares is subject to tax as capital income at 30 percent up to EUR30000 and 34 percent for the exceeding part. The RSUs are subject to NI and income tax at your marginal rate on their value at the time they vestYou can either choose to pay the tax yourself and receive all the sharesbut most people will opt to have shares deducted to pay for these deductionsSo if you are a higher rate tax payer you will be due to pay 42 tax and NI which would mean your 50 shares would. The loss from the sale of shares can be carried forward up to 5 years.

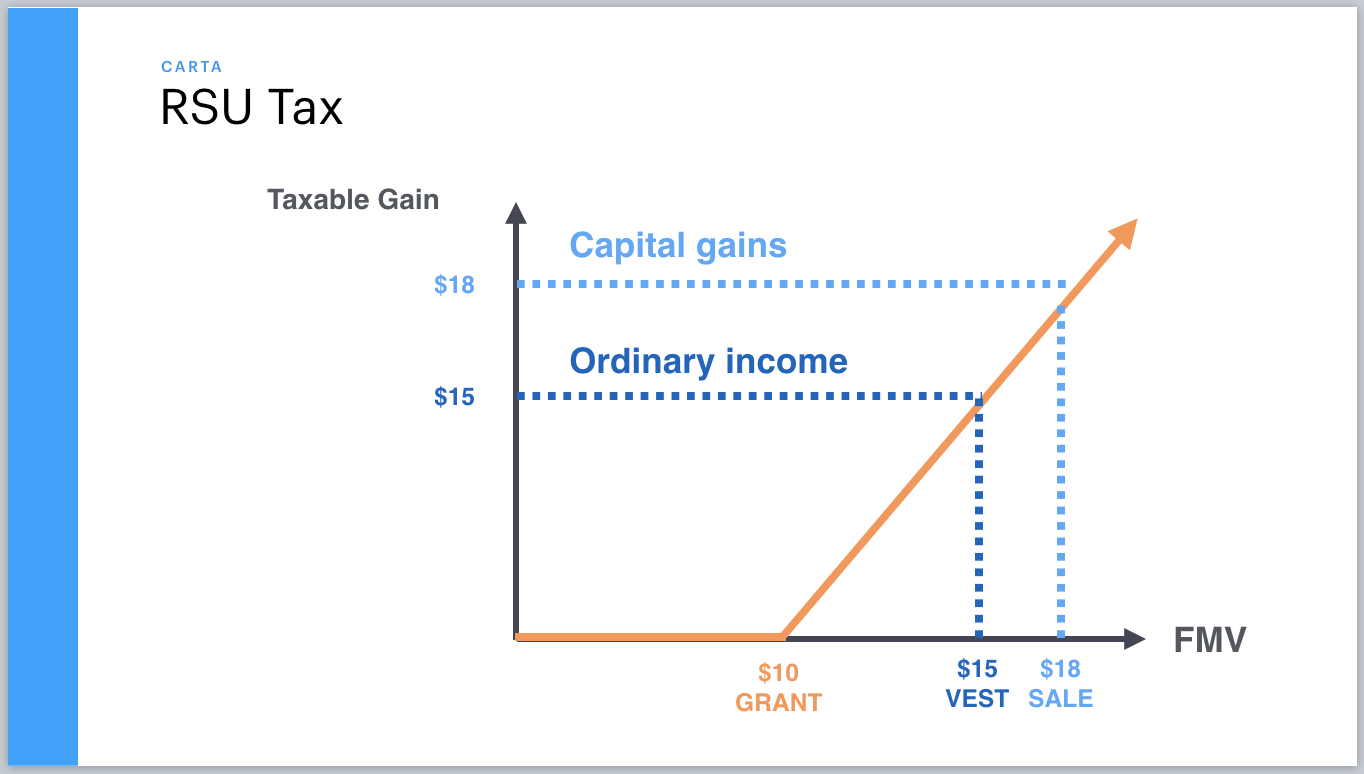

Restricted stock and RSUs are taxed upon delivery and subject to progressive income tax up to 56 percent. You pay no CGT on the first 12300 that you make. This rate is 238 20 plus the 38 tax on net investment income for high-earning taxpayers.

If the employee is a basic-rate taxpayer the income tax charged would be 6 12 20 or 40 of 30 depending on the tax status of the employee. Employers will usually deal with this under PAYE and so if you are the recipient of some RSUs initially there is nothing you need to do to make that happen. Think of them like a cash bonus thats linked to the price of your companys stock.

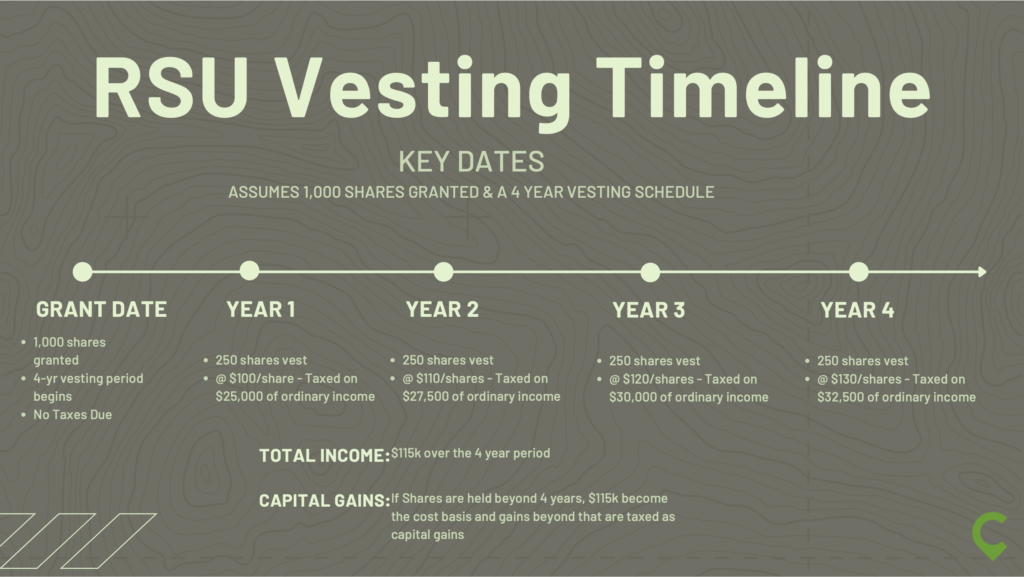

US RSUs vested and sufficient shares were sold to cover the 47 tax withholding obligation plus commission and fees. On the other hand the rate for short term gains is the same as that for earned income which is 37 for high-income taxpayers. A typical vesting schedule is where 25 of the shares vest per year over four years.

When your RSUs vest you will pay income tax and employee national insurance. 50 Tax and NIC paid. Capital gains tax CGT breakdown.

If the RSUs take you over 100000 you will pay income tax at a marginal rate of 60 plus the employers National Insurance. Acquiring RSUs RSUs are not taxable when they are granted. Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained.

So RSUs which do confer upon the recipient a right to acquire securities - see ERSM110500 will be taxed under Chapter 5. RSU compensation is taxed as ordinary income when the shares vest and based on your shares value on the vesting date. Extra tax of 4310 due to loss of personal allowance as income above 100000 employee nic 2 431.

Employers have the discretion to either pay this themself. How Are Rsus Taxed In The Uk. Income tax 40 of Remaining 8620.

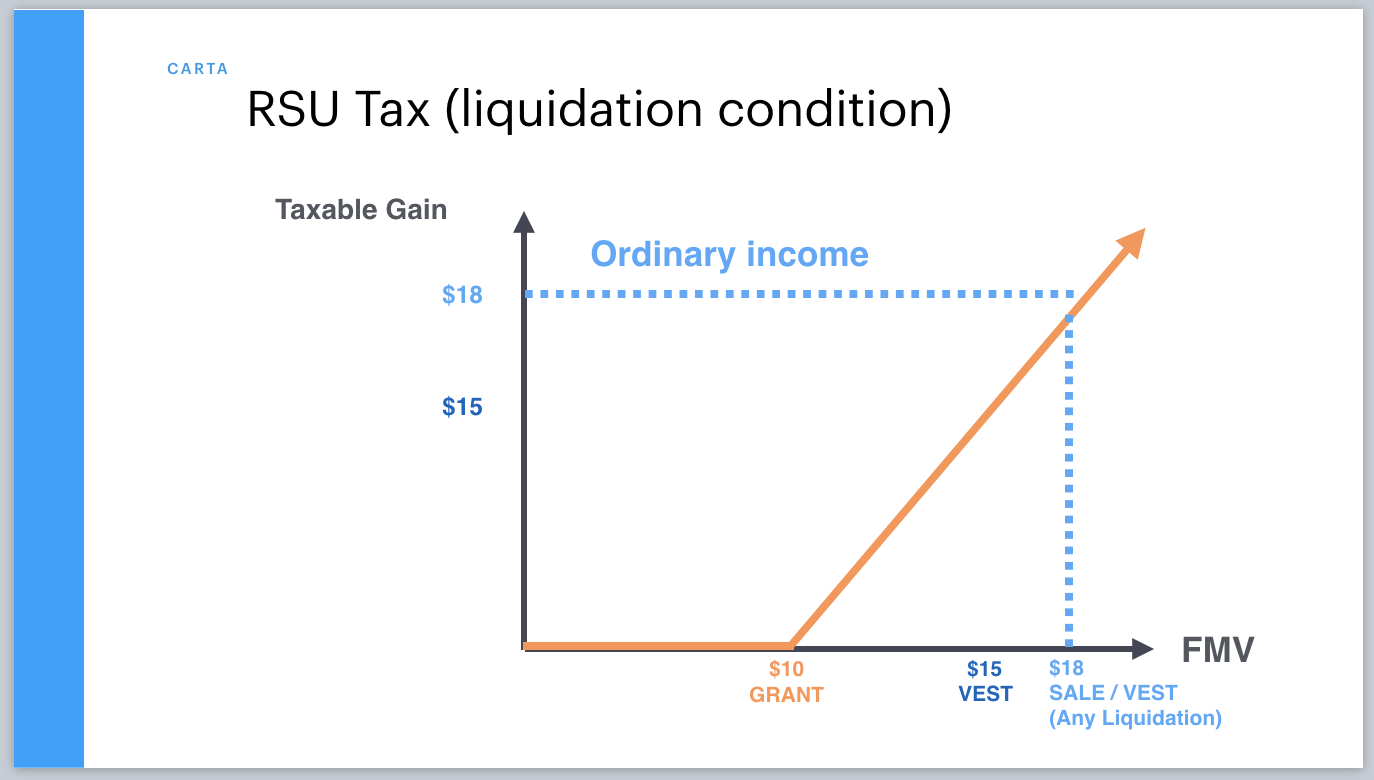

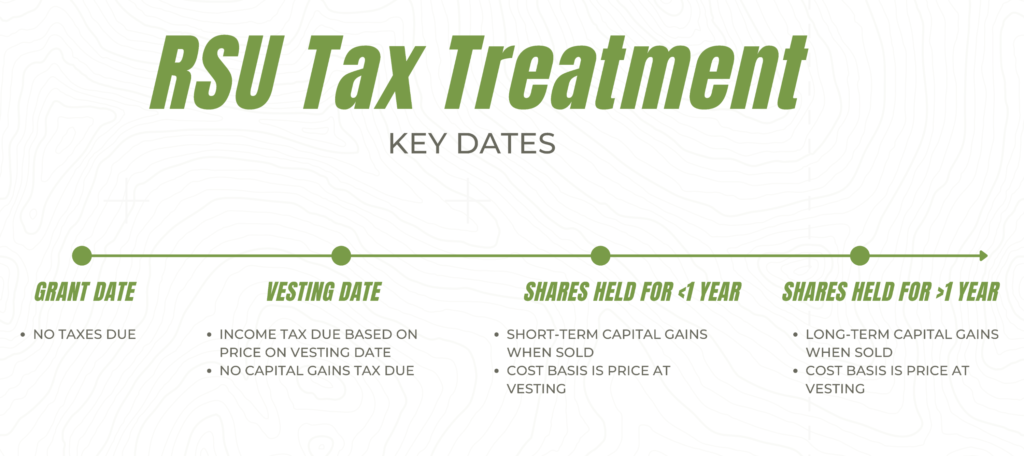

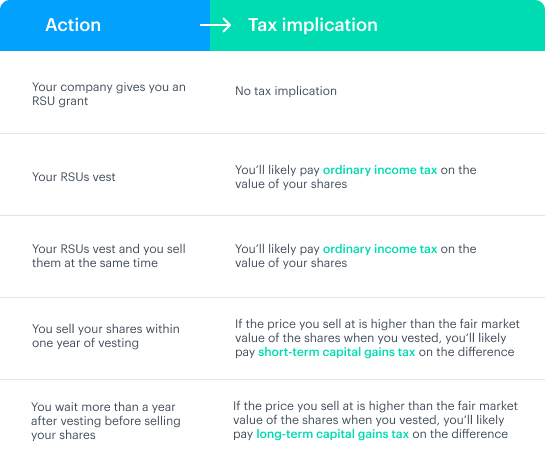

Taxes at RSU Vesting When You Take Ownership of Stock Grants. You will owe income tax both federal and state if. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest.

The RSUs are subject to NI and income tax at your marginal rate on their value at the time they vestYou can either choose to pay the tax yourself and receive all the sharesbut most people will opt to have shares deducted to pay for these deductionsSo if you are a higher rate tax payer you will be due to pay 42 tax and NI which would mean your 50 shares would. This is different from incentive stock options which are taxed at the capital gains rate and tax liability is. RSUs are free of tax from the start.

For tax purposes RSUs are not taxable. When your restricted stock units vest and you actually take ownership of the shares two dates that almost always coincide the value of the stock at that vesting date gets included in your income for the year as compensation. The proceeds from this sale were used to pay the UK tax and NI charged through the UK payroll when the total value of.

RSU vested in 202122 tax year. If the rsus take you over 100000 you will pay income tax at a marginal rate of 60 plus the employers national insurance. In reality the difference is the rsu taxes left.

Total Tax and NIC. At this point the employee is charged to income tax on 30. Residual Value After All Tax.

You only pay tax on RSUs when they vest. You pay 1286 at 20 tax rate on the remaining 6430 of your capital. How Are Restricted Stock Units RSUs Taxed.

Less National Insurance 2-345. If you already earn in excess of this and the RSUs take you over 150000 you will pay 45 income tax plus the employers National Insurance. If the employee received the RSU for free the employment tax charge would be 80.

The taxable amount will be the fair market value of the shares issued to you at vesting. Employee total salary before RSU is 100000. The tax payment is usually the last step before the shares eg.

Extra tax of 4310 due to loss of personal allowance as income above 100000 Employee NIC 2 431. Unlike a salary that is subject to taxes RSUs in the UK are tax-free. A RSUs isnt taxable when it is granted in any case.

The first time that they are exposed to tax is upon vesting at which time both income tax and NIC are due. You pay 127 at 10 tax rate for the next 1270 of your capital gains. Top of page RSUs that provide cash on vesting.

In all cases there is no tax to pay when RSUs are granted. Taxation of RSUs. The taxation of RSUs is a bit simpler than for standard restricted stock plans.

Rsus Can Also Be Subject To Capital. You may also need to pay for employers national insurance. In your case where your capital gains from shares were 20000 and your total annual earnings were 69000.

As a result of withholding taxes you shall receive the net amount. Less 60 Income Tax 40 Higher Rate Tax plus Loss of Personal Allowance-10344. Shares tax will be paid in advance.

Net RSU Value Before Employer Income Tax NI. Salary 100000 RSU Value 25000. The UK tax treatment for RSUs is similar to how your salary is taxed.

On the restriction lifting the share is now worth 200. Because there is no actual stock issued at grant no Section 83 b election is permitted.

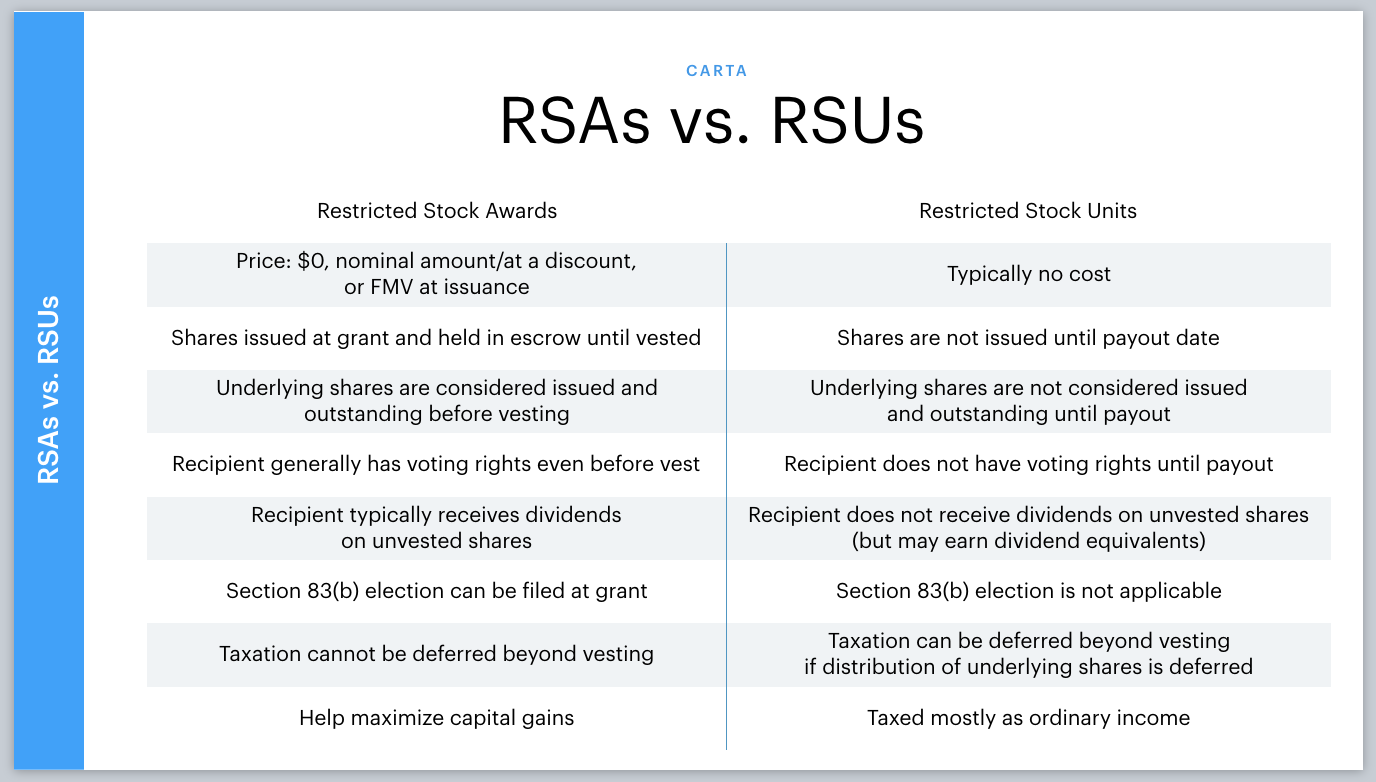

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

A Tech Employee S Guide To Rsus Cordant Wealth Partners

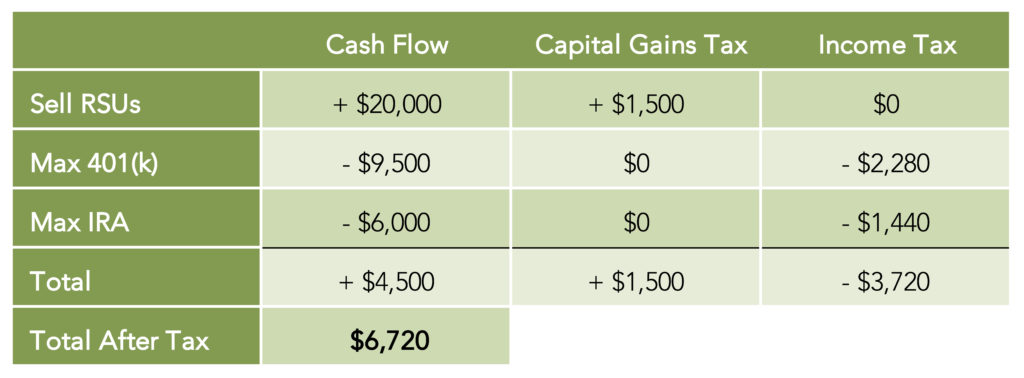

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Liberating Restricted Stock Units The Rsu Conundrum Tanager Wealth

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

United States What Is The Purpose Of An Rsu Tax Offset Personal Finance Money Stack Exchange

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

What Is A Restricted Stock Unit Rsu Everything You Should Know Carta

How Are Restricted Stock Units Taxed In Canada Ictsd Org

How To Avoid Taxes On Rsus Equity Ftw

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Pro Tips 4 Tax Return Errors To Avoid With Stock Options Rsus And Stock Sales

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Pro Tips 4 Tax Return Errors To Avoid With Stock Options Rsus And Stock Sales

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

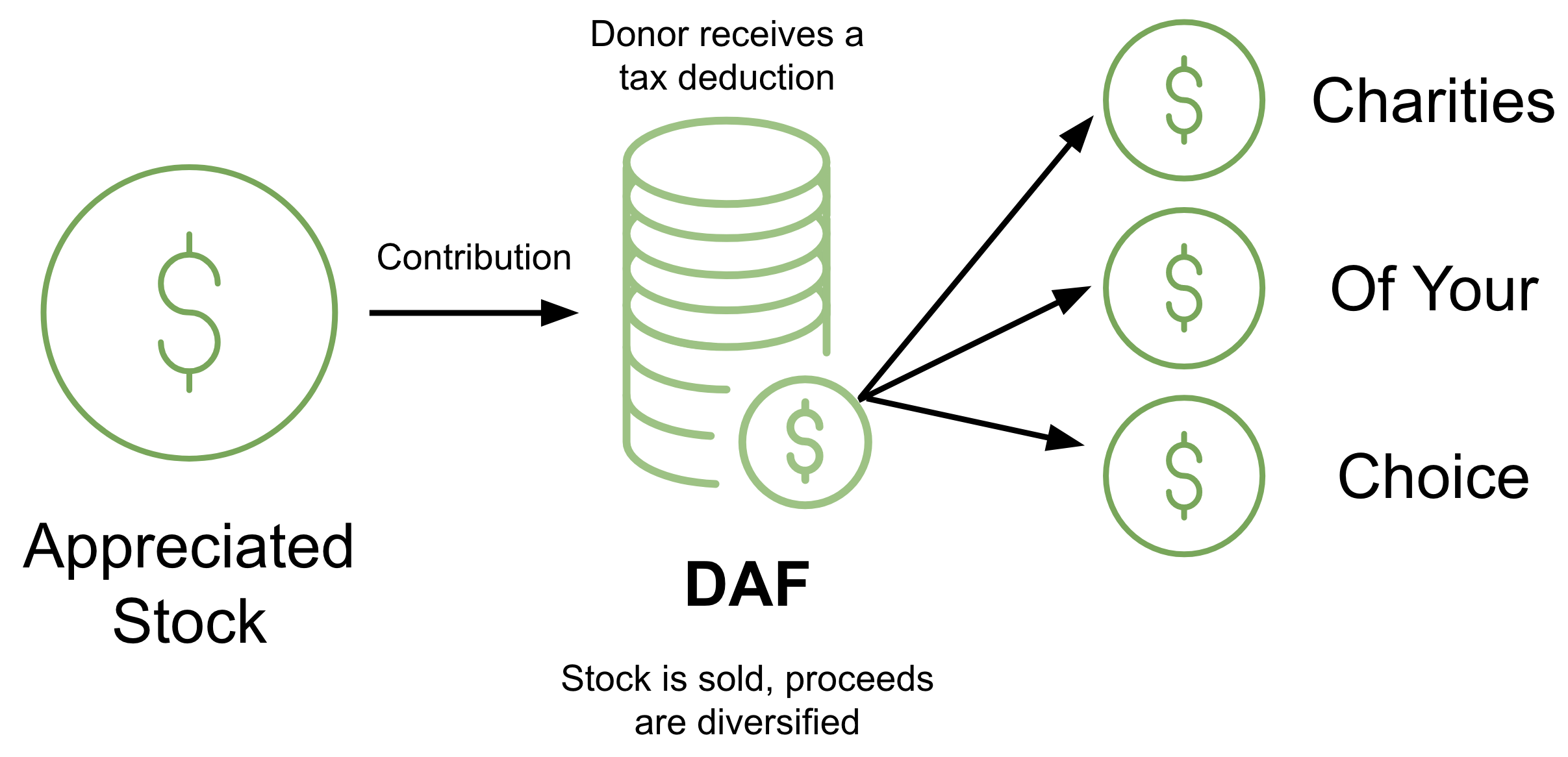

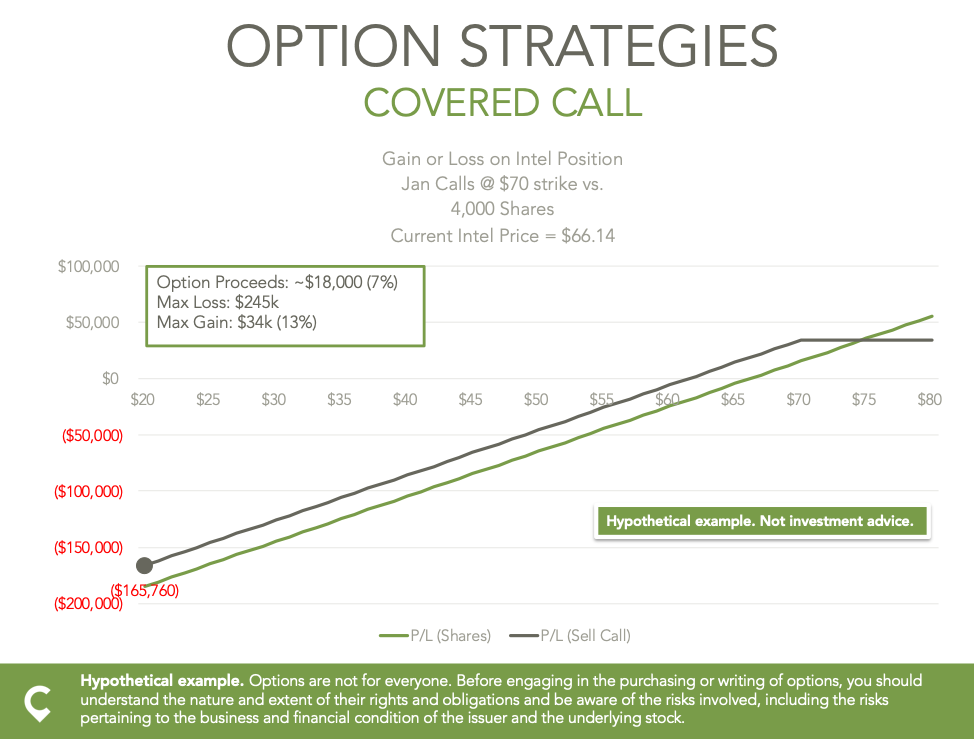

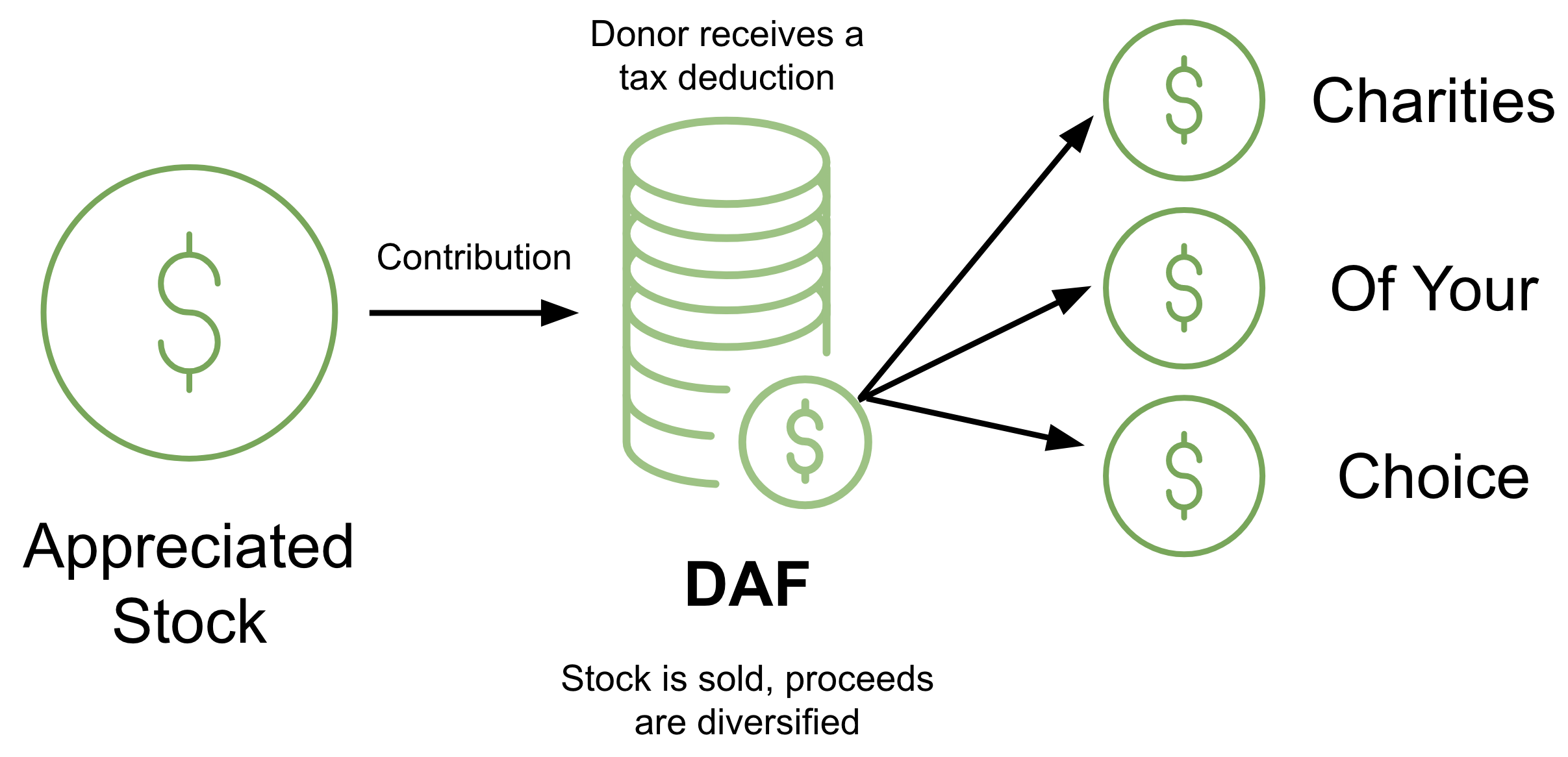

How To Avoid Taxes On Rsus Equity Ftw

Taxation Of Restricted Stock Units Rsus Carter Backer Winter Llp